does wyoming charge sales tax on labor

Clarification needed is the person who prepares and files the Certificate of Incorporation with the concerned state. The tax impact of the bidding process.

Commercial Construction Cost Per Square Foot In The U S Bigrentz

2 personal data collected by unaffiliated sites that link to or are accessible from our Services.

. To keep up-to-date please visit our COVID-19 Resources site which will be updated as new information becomes available. A customer living in Toledo Ohio finds Steves eBay page and purchases a 350 pair of headphones. When shipping the vast majority of items you do need to charge sales tax in regards to the shipping charge.

Heres a labor cost example. This Policy does not apply to 1 personal data controlled by our Customers employers that utilize our Services described further below. Incorrectly estimating sales tax can have a big impact on a construction project.

Previously taxed services included those which modify or repair a product. At a total sales tax rate of 725 the total cost is 37538 2538 sales tax. 3 personal data our partners may collect directly.

We are not affiliated with the Internal Revenue Service or any other federal or state organizations. The sales tax on shipping does not need to be charged if. The areas of Montana that attract many tourists and house resorts have low sales taxes of up to 3 referred to as a resort and local option tax.

There are specific state taxes that might apply to your business. Learn more about state sales tax and franchise taxes in our state sales tax guides. Montana- The imposed sales tax is an exception to the 000 state sales tax rate.

Registered agents are responsible for receiving all legal and tax documentation on behalf of the corporation. Texas Sales Tax Application Assistance Support - Sales Tax Application Organization - Call. When calculating the sales tax for this purchase Steve applies the 575 state tax rate for Ohio plus 15 for Montgomery county.

It is important to have a consistent employee timesheet software or app for long term labor cost success. The Equifax COVID-19 Resources site includes a 2022 Tax Guide intended to assist employers in identifying potential risks associated with increases in SUI tax costs from 2021 to 2022 eg changes in minimum and maximum SUI tax rates changes. Louisiana - Levies a 25 state tax plus 05 local tax.

Labor that is taxable usually labor used in the production of tangible goods. The sales tax rate of 935 applies to rental or lease of a passenger motor vehicle for a period of 30 or more days. We do not provide legal financial or other professional advice.

Are services subject to sales tax in Kentucky. Mississippi - Plus 5 state sales tax 2 below the state general sale tax. Youll probably need an exemption certificate from the organization or depending on local laws you may be able to have the organization itself purchase the materials if the tax exemption does not extend to you.

If they work 40 hours per week for 52 weeks they will work 2080 hours which makes their labor cost 31200 pre-tax per year. Labor and services such as car repair. The state of Kentucky does not usually collect sales taxes on the many services performed but in 2018 passed laws broadening the base of which services can be taxed.

Using dedicated business banking and credit accounts is essential for personal asset protection. If you sell tangible goods in Texas that are taxable than you would charge sales tax on shipping and handling charges. Open a business bank account credit card.

Lets say an employee is paid 15 per hour. Share per value refers to the stated minimum value and generally doesnt correspond to the actual share value. The state of Florida has very simple rules when it comes to taxes on shipping.

Welcome to State of Wyomings application process.

Labor Day Appliance Sales And Deals 2021 Sales To Shop Now

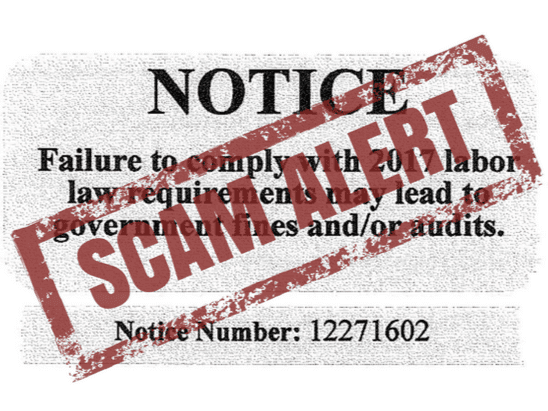

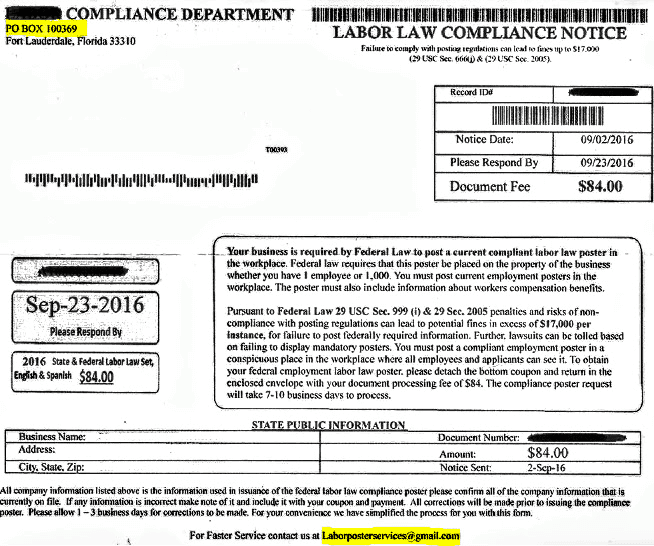

4 Signs Of A Labor Law Compliance Scam

Wyoming Sales Tax Small Business Guide Truic

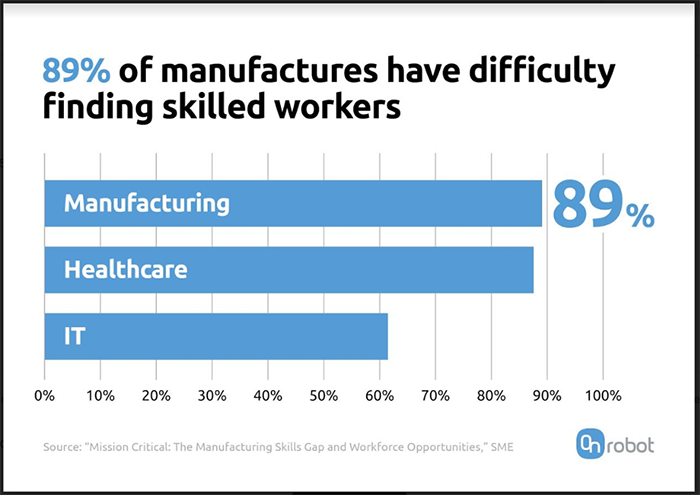

How Collaborative Automation Is Addressing The Massive Worldwide Labor Gap Onrobot

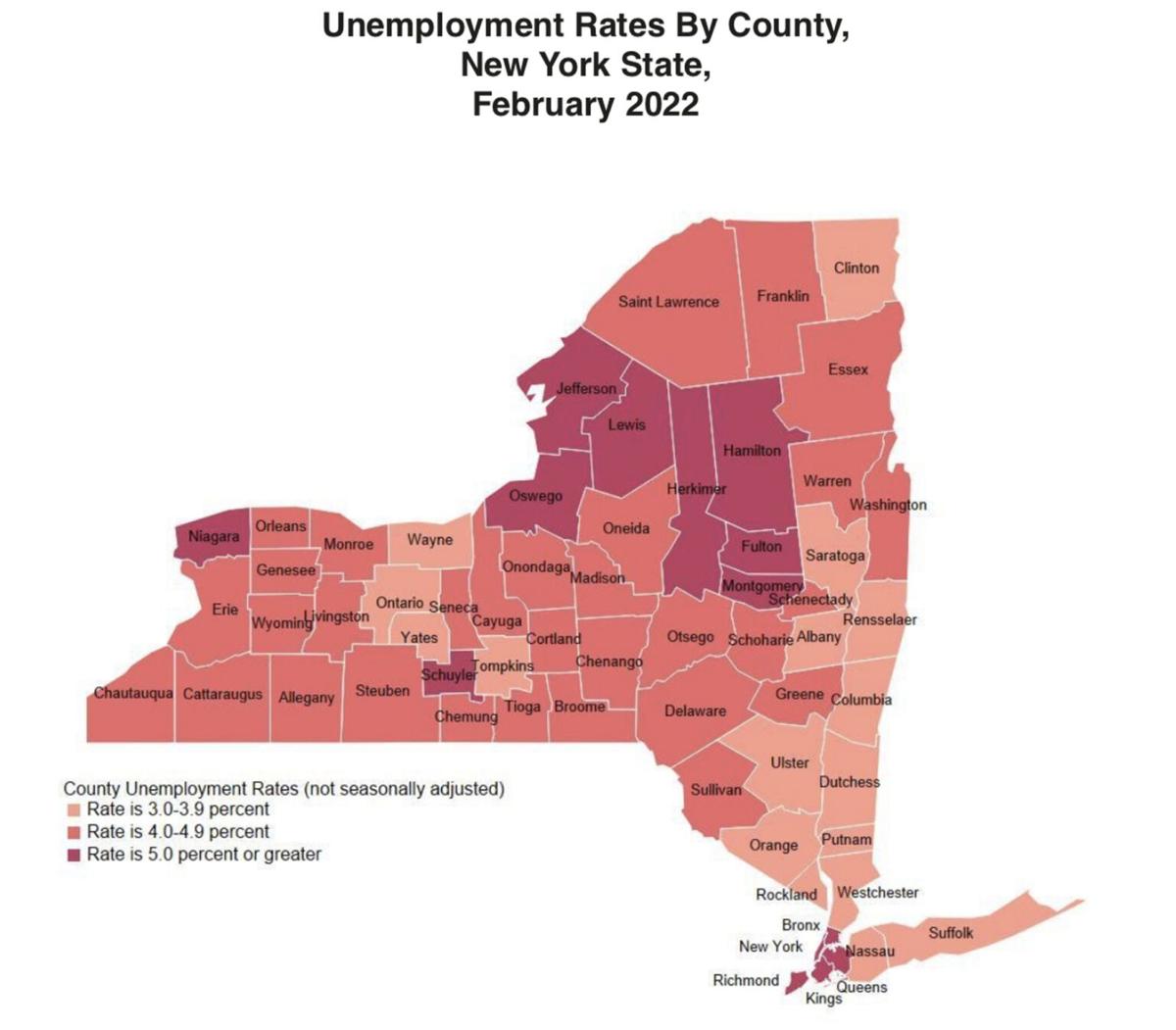

Department Of Labor Orleans And Wyoming Counties Top Glow Region Unemployment Rates Local News Thelcn Com

4 Signs Of A Labor Law Compliance Scam

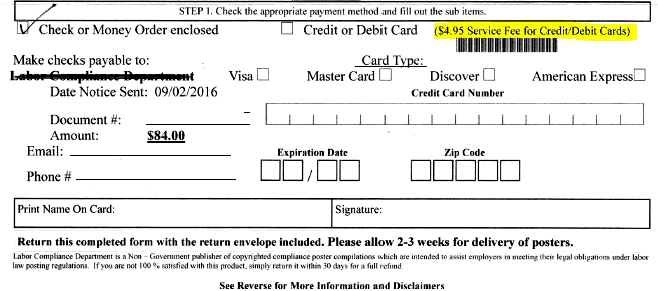

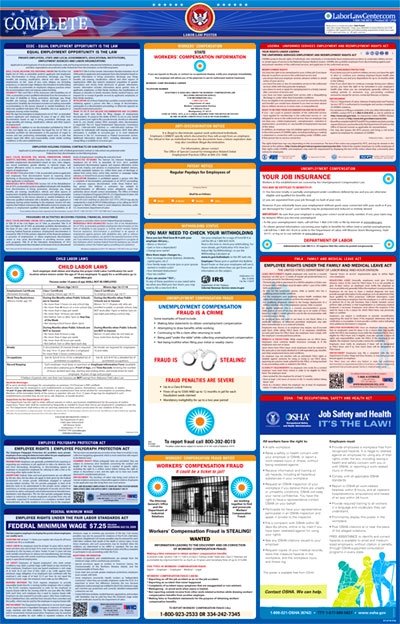

2022 Wyoming Labor Law Posters State Federal Osha Laborlawhrsigns

Living Wage Annual Expenses To Support A Family By Us State Map Supportive States

The Labor Market During The Great Depression And The Current Recession Everycrsreport Com

Virginia Labor Law Poster 2021 Replacement Service Va Labor Law Posters

Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation

4 Signs Of A Labor Law Compliance Scam

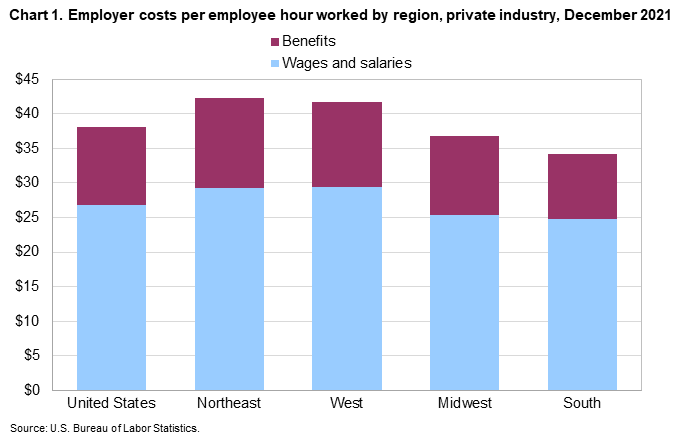

Employer Costs For Employee Compensation For The Regions December 2021 Southwest Information Office U S Bureau Of Labor Statistics

Free 2022 Illinois Labor Law Posters Labor Law Center

Challenges Opportunities Of The Current Labor Shortage

Employment Laws Rules To Follow While Interviewing Hiring

/5278798677_0429e6aa05_k-7b6b81bdbbe44cdb929c08c7da9f8d29.jpg)